‘87,000 IRS agents’ is the zombie falsehood setting the House agenda

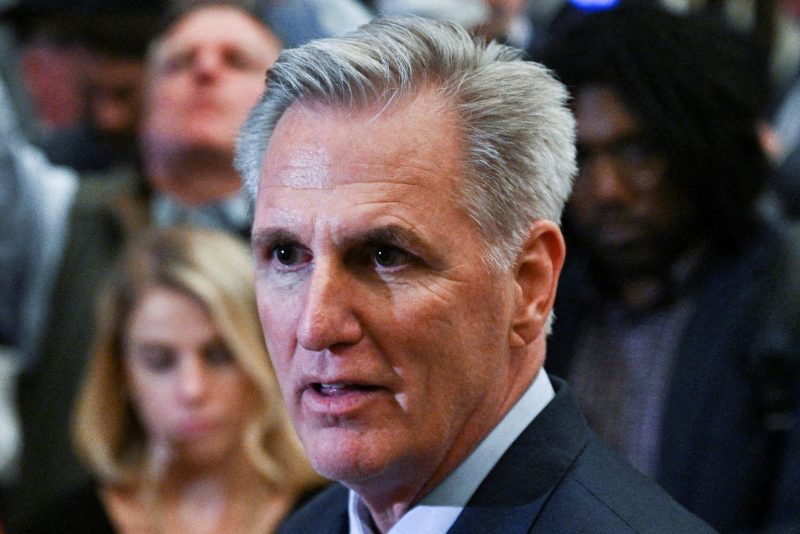

“Our very first bill will repeal the funding for 87,000 new IRS agents.”

— House Speaker Kevin McCarthy (R-Calif.), in remarks on the floor, Jan. 7

“THIS WEEK — The House Republican Majority will move to pass legislation to defund the 87,000 new IRS agents.”

— House Majority Leader Steve Scalise (R-La.), in a tweet, Jan. 8

Republicans took charge of the House of Representatives this week — and put forward as their first act a bill that is based on a repeatedly debunked falsehood.

We call these “zombie claims,” as they keep rising up from the dead no matter how often they have been fact-checked. But we haven’t before witnessed such a roundly criticized claim set the agenda for a new Congress. On Monday night, on a party-line vote of 221-210, the House approved a bill stripping $71 billion in funding from the Internal Revenue Service. (It has no chance of passage in the Senate, and President Biden has promised a veto.)

Back in August, we first criticized what McCarthy called “the Democrats’ new army of 87,000 IRS agents,” saying the figure was wildly exaggerated.

The figure had been plucked from a Treasury report released in May 2021 about how the administration hoped to address the “tax gap” — the difference between what is owed to the government and what is actually paid. That difference was thought to be at least $381 billion a year, with most of it due to underreporting of income, according to the nonpartisan Joint Committee on Taxation.

One major problem is that the IRS does not have enough experienced revenue agents who can tackle complex tax returns. In a May report last year, the Government Accountability Office (GAO) said audit rates have declined dramatically for the super rich. In 2010, more than 21 percent of tax returns reporting more than $10 billion in income were audited — and that dropped to 3.9 percent by 2019, GAO said.

On Page 16 of the Treasury report, a chart shows that almost $80 billion in new resources over 10 years would allow for the hiring of 86,852 full-time employees in the next decade.

When Congress last year passed a bill with something close to that amount of money, Republicans began to claim that all these new employees were “agents.”

The Biden administration has not released its strategic plan about how it would use the money, but a little over half is targeted for enforcement. In other words, many would not be “agents” — but employees hired to improve information technology and customer service.

The IRS has about 79,000 employees, down from about 95,000 in fiscal year 2012. But the new hiring does not mean the agency’s staff will double, as some Republicans claimed during debate on the legislation. The Congressional Budget Office assumes, absent additional funding, IRS staffing would keep falling to about 60,000 in 10 years, so the funding would allow a doubling from that base, or an increase of 50 percent from today’s levels.

But Treasury officials say that because of attrition, after 10 years of increasing spending, the size of the agency should only grow 25 to 30 percent when the hiring burst is completed. In congressional testimony in 2021, IRS Commissioner Charles Rettig said the agency will need to “replace more than 50,000 workers lost through attrition over the next six years.”

Currently, only about 10,000 IRS employees, or about 13 percent of total staff, are “agents,” who audit tax filings or investigate tax crimes. According to GAO, “it takes 4 to 5 years to train a new hire to become an experienced senior or expert revenue officer.”

The administration has asserted that “audit scrutiny” would not be raised on small businesses or middle-income Americans, yet Republicans have dubbed their new bill the Family and Small Business Taxpayer Protection Act. While the bill could eliminate the money to hire employees, the Congressional Budget Office said that, paradoxically, it would raise the budget deficit by almost $115 billion over 10 years because anticipated tax revenue would not materialize.

The House Ways and Means Committee, in its one-page description of the bill, claims that the bill would block “the Biden administration from unleashing 87,000 new IRS agents to go after families and small businesses.”

All of these facts show how ridiculous this claim is. The hiring is over a decade, much of it replaces pending retirees, and many of the new employees are not agents. The targets of increased scrutiny are the wealthy, not the middle class. Fact check after fact check has demonstrated this. But politicians such as McCarthy and Scalise keep saying it — and then it gets repeated across social media. Here’s the rundown of some of the other fact checks:

PolitiFact (August): “Mostly False” — “The 87,000 figure is flawed because not all of those employees would work in IRS enforcement, and not all of them would be new workers added to the overall workforce.”FactCheck.org (August): “False claim” — “Not all of the new hires will be ‘agents.’ There’s a big difference between IRS agents, such as revenue agents and special agents, and the workers who make up the bulk of the IRS staff.”Time (August): “Not true” — “Trump Allies Are Attacking Biden For a Plan to Hire 87,000 New IRS Agents That Doesn’t Exist”Reuters (August): “False” — “The Internal Revenue Service will not be hiring 87,000 armed agents”USA Today (October): “False” — “Tax policy experts told USA TODAY a majority of the hires will not be special agents.”New York Times (November): “Misleading” — “The additional funding for … the I.R.S. will allow the agency to modernize its infrastructure and replace an aging workforce.”

Media representatives for Scalise and McCarthy did not respond to queries asking why they kept using this false talking point.

We originally gave this claim Three Pinocchios, as at least Republicans could point to a number in a Treasury report. But now, after repeated fact checks, there is really no excuse, and we are upping the rating to Four Pinocchios.

Republicans clearly prefer to say “agents” rather than a more accurate “employees” — we suspect polling shaped this talking point — but that’s untethered from reality. Yet, here’s this zombie claim again, enshrined in a proposed law.

(About our rating scale)

Send us facts to check by filling out this form

Sign up for The Fact Checker weekly newsletter

The Fact Checker is a verified signatory to the International Fact-Checking Network code of principles